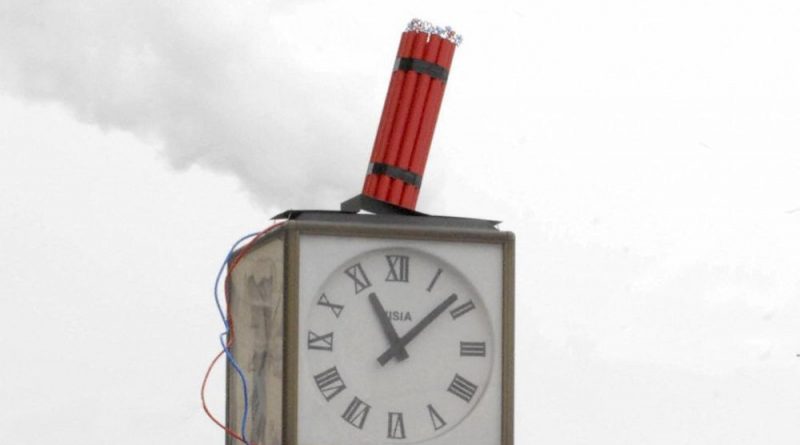

The Market Time Bomb That’s Bigger Than the VIX (Bloomberg)

- Loan funds pose a potential liquidity problem, which could have a destabilizing effect.

As bad as the stock market turbulence has been from volatility-linked products, it could be even worse some day because of exchange-traded loan funds.

Stock tumbles have a way of pointing out investments that seemed like safe bets but turned out to be unstable, propped up solely by rising markets. And when these bets unwind they tend to take down the wider market with them. In the recent market drop, volatility-linked investment funds, which in retrospect are being called an $8 billion ticking time bomb, emerged as the culprit. A number of the exchange-traded products were wiped out, and it appears the unraveling hastened the stock market’s fall.

Exchange-traded loan funds bear a lot of similarity to the volatility funds that average investors have flocked to for safety, except that they are much bigger. Volatility-linked ETFs grew to include about $8 billion in investments. The PowerShares Senior Loan ETF has nearly that much in it alone. Last month, LCD, a unit within S&P Global Market Intelligence, said that assets under management in loan funds had grown to more than $156 billion, up from around $110 billion two years ago.

Critics have grumbled about bond funds for years but have been mostly ignored by investors who have piled into loan funds thinking that the floating-rate debt will protect them from losses when interest rates rise. Top bond fund manager Thomas Atteberry of FPA New Income has recently warned in investor presentations that leveraged loans may not offer the interest rate protection that investors are counting on.

But the big, potentially market-destabilizing problem hidden in bond funds has to do with liquidity. ETFs, like stocks, can be bought and sold in milliseconds. But bank loans cannot. Loans trade in over-the-counter markets with much less volume and settlement times that can stretch out a month. The worry is that investors will stampede out of loan ETFs, which account for about $10 billion of the $156 billion in loan fund investments, faster than the ETF managers can sell the underlying loans in their portfolio. This would cause a gap in the value of the ETF and the value of the loans in it, or worse, the possibility the funds may not be able to immediately come up with money for investors looking to cash out. Fear of not being able to get your money back is what causes bank runs and financial mayhem in general. The problem could be compounded by loan mutual funds, which make up a much larger share of that $156 billion and could also encounter a liquidity mismatch problem, though not as extreme as ETFs. Four years ago, Larry Fink, the CEO of BlackRock Inc., one of the largest providers of ETFs, warned that he thought loan ETFs, along with leveraged ETFs, were too risky for individual investors and not something his company would offer. BlackRock repeated a warning about certain ETFs on Tuesday, though it didn’t identify loan ETFs directly.

And that’s not the only source of potential destabilization in the loan market. The other big buyer of loans has been collateralized loan obligations, which buy and sell loans like funds but raise money like bonds. CLO offerings raised $118 billion last year, up from $72 billion the year before. CLOs don’t have the liquidity problem that ETFs have, but they may have a structural problem. CLOs, to maintain their relatively high yields, typically buy loans with an average credit rating of B, which tend to have default rates in the double digits during downturns. However, most BBB bonds tied to CLO deals would start to default if just 9 percent of the loans in the CLO were to default. Recently, the loan default rate has been much lower than that, around 2 percent, and CLOs have performed well. Loan ETF providers have also combated criticism by saying theoretical liquidity problems have yet to materialize, even during the financial crisis.

But there are signs that problems could be on the horizon, particularly globally. Credit ratios worsened in emerging markets last year, according to a report this week from S&P Global Ratings, though ratios in North America and Europe improved. Overall, global nonfinancial corporate debt grew by 15 percentage points to 96 percent of GDP from 2011 to 2017, the bond ratings agency said. “When debt is this steep and default rates are low, something’s gotta give,” S&P analyst Terry Chan wrote in the report.

Red Is the New Black

Netflix is one of a number of highfliers counting on debt markets to fund its growth plans.

As the loan market has grown — issuance rose 50 percent last year to $1.5 trillion — it has become a bigger part of how large companies fund themselves, crowding out other more traditional funding markets like high-yield debt. And more large companies, including some of the market’s highest fliers, are counting on credit markets to fund their growth. Netflix, for example, recently told investors that it expects its operations will burn through as much as $4 billion in cash next year. Tesla appears to have run through nearly that much last year. Telecom giant AT&T has nearly $126 billion in long-term debt, nearly double what it had just five years ago. Investors have grown nervous that a number of regional telecoms, including CenturyLink and its $18 billion in long-term debt, could be at risk of default. An investor retreat from the loan market because of some shock would certainly take a bite out of the FANG tech stocks, and likely many others.

All this is a recipe, if not for disaster, than at least a potential nasty market drop. Investors just saw what happens when $8 billion has flooded into an unsustainable investment. Imagine what will happen when even more tries to get out of another.

Source: Bloomberg